The VanEck DJD ETF has been gaining considerable attention in recent years. This portfolio offers capital allocators exposure to the dynamic world of analytics companies. To truly understand its performance, it's necessary to analyze various factors.

- Primary determinants include the ETF's structure, its underlying benchmark, and its fee structure.

- Moreover, it's recommended to assess the ETF's long-term performance against comparable ETFs and industry standards.

By undertaking a comprehensive analysis, investors can obtain valuable insights into the Invesco DJD ETF's potential for their investment objectives.

Tapping into Growth with Dividends: The DJD ETF Strategy

Investors seeking steady income and potential for financial growth may find the DJD ETF strategy particularly compelling. The DJD ETF, which tracks a meticulously chosen index of dividend-paying businesses, offers exposure to a diverse range of sectors known for their consistent dividend histories. By investing capital in this ETF, investors can smoothly tap into the power of dividends while gaining broad market coverage.

- Furthermore, the DJD ETF's results has historically demonstrated resilience even during periods of market volatility. This makes it an attractive option for investors seeking both income and long-term growth potential.

- Proactively allocating a portion of your portfolio to the DJD ETF can enhance your overall investment strategy, providing a valuable source of passive income and risk management.

Concisely, the DJD ETF offers a compelling opportunity for investors to accumulate consistent dividend income while participating in the growth potential of the broader market.

Introducing the DJD ETF: Unlocking High-Yield Dividend Opportunities

Are you seeking a way to earn passive income through your investments? Consider exploring the world of high-yield dividend ETFs, where funds like the DJD ETF offer promise for consistent returns. The DJD ETF focuses on companies that offer attractive dividends, giving investors with a steady stream of income.

That guide will delve into the intricacies of the DJD ETF, exploring its assets, results, and benefits for your investment portfolio. Whether you're a seasoned investor or just beginning your investment journey, understanding the fundamentals of high-yield dividend ETFs like the DJD ETF can be invaluable.

- Comprehending the DJD ETF's Investment Strategy

- Examining the DJD ETF's Holdings and Performance

- Challenges of High-Yield Dividend Investing

Analyzing the Performance of the Dow Jones Industrial Average Dividend ETF (DJD)

The Dow Jones Industrial Average Dividend ETF (DJD) is currently demonstrate a robust performance record, making it an appealing investment option for investors seeking income. Evaluating DJD's performance requires a thorough assessment of its underlying holdings, market conditions, and previous trends.

Investors should meticulously review DJD's expense ratio, payout ratio, and market depth before making an strategic choice.

Is DJD the Right ETF for Your Dividend Portfolio?

With a growing number of investors seeking dividend income, Exchange Traded Funds (ETFs) like DJD have become increasingly in-demand. DJD specifically focuses on the performance of dividend-paying companies. But is it truly the best choice for your portfolio? That relies on a variety of factors, including your portfolio goals, risk tolerance, and overall strategy.

- First, evaluate your dividend needs.

- Next, understand DJD's holdings and its track record.

- Ultimately, compare DJD against other dividend-focused ETFs to pinpoint the best fit for your portfolio.

Surfing the Wave of Dividends: Examining DJD ETF's Outcomes

Investors seeking steady income streams are often drawn to dividend-paying equities. One popular choice is the Schwab High Yield ETF (DJD), which tracks a broad basket of dividend-focused companies. DJD's latest performance has attracted attention, DJD vs DIA: Which is better for Dow exposure? with some highlighting its ability to survive choppy market scenarios. However, understanding DJD's trajectory requires a deeper dive into its underlying holdings, sensitivity profile, and future prospects.

- Analyzing DJD's top holdings reveals a concentrated portfolio with exposure to multiple industries. This can provide market resilience.

- Key performance like dividend yield and total return offer insights into DJD's historical success.

- Projecting ahead, investors should consider factors such as interest rate hikes, inflation dynamics, and the overall forecast. These factors can substantially impact DJD's future outcomes.

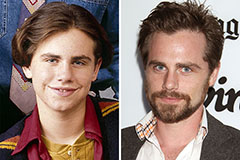

Rider Strong Then & Now!

Rider Strong Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

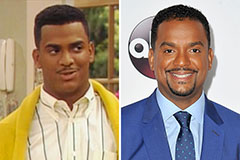

Alana "Honey Boo Boo" Thompson Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!